swap in forex means

50 Bonus on Deposit Sometimes Forex traders wish they could afford higher margin trades but theyre not ready for the risk. Forex trading involves significant risk of loss and is not suitable for all investors.

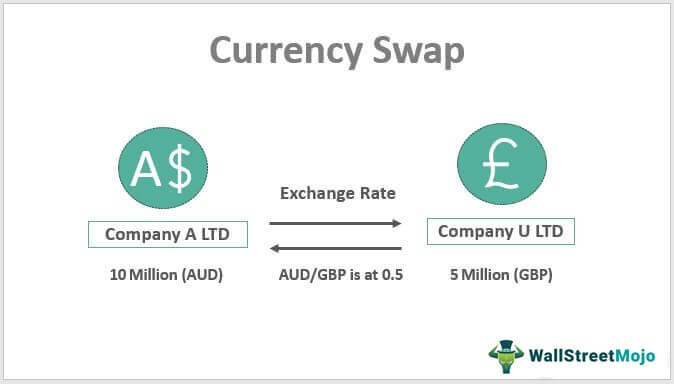

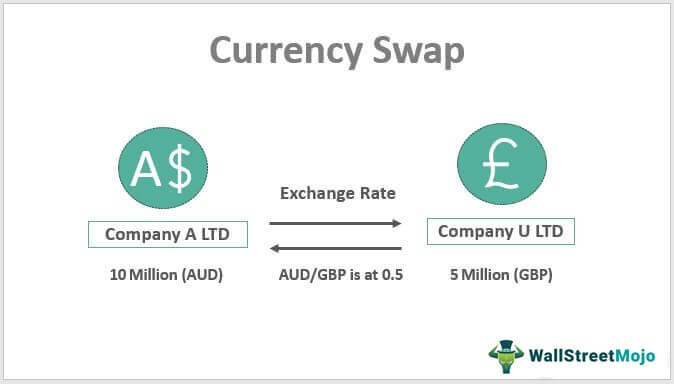

Currency Swap Definition Example How This Agreement Works

According to the RBI the minimum bid size will be 10 million and in multiples of 1 million thereafter reported the Hindu Business Line.

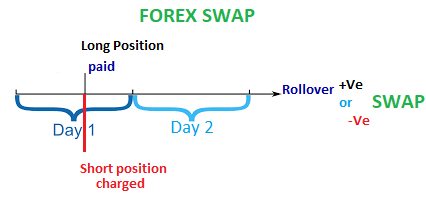

. For instance if you hold a forex and CFD position open for longer than one day you will pay or receive overnight financing fees also known as swap rates. Average execution speeds of under 40ms Low latency fibre optic and Equinix NY4 server. For todays Forex traders this means that they need no longer feel Forex-deprived because of short balances or lack of access to the global exchange market.

Overnight fees are sometimes called swap fees or rollover fees these fees are applied if you hold an open position overnight which means when trading markets close. A guaranteed stop means the firm guarantee to close the trade at. Spot Gold and Silver contracts are not subject to regulation under the US.

This is our list of the best Forex brokers in Malaysia. It is an important risk management tool. Best leverage in forex trading depends on the capital owned by the trader.

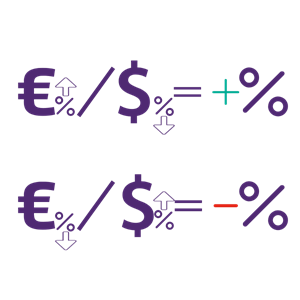

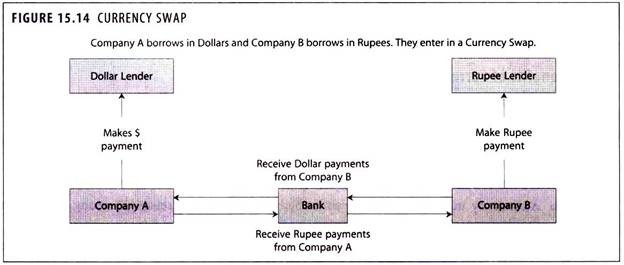

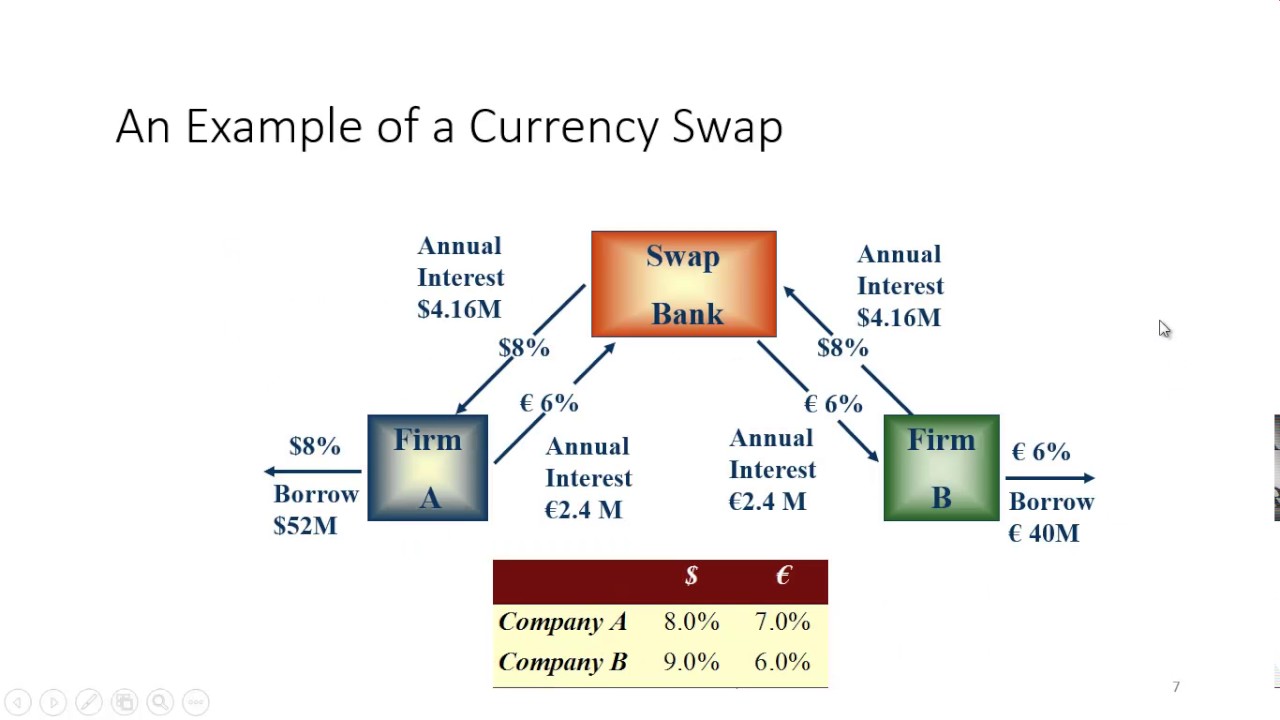

Parties with significant forex exposure and hence currency risk can improve their risk-and-return profile through currency swaps. Choosing AvaTradeGO app for android and iOS mobile means you will get access to AvaTrades exclusive risk management tool known as AvaProtect. Currencies trade against each other as exchange rate pairs.

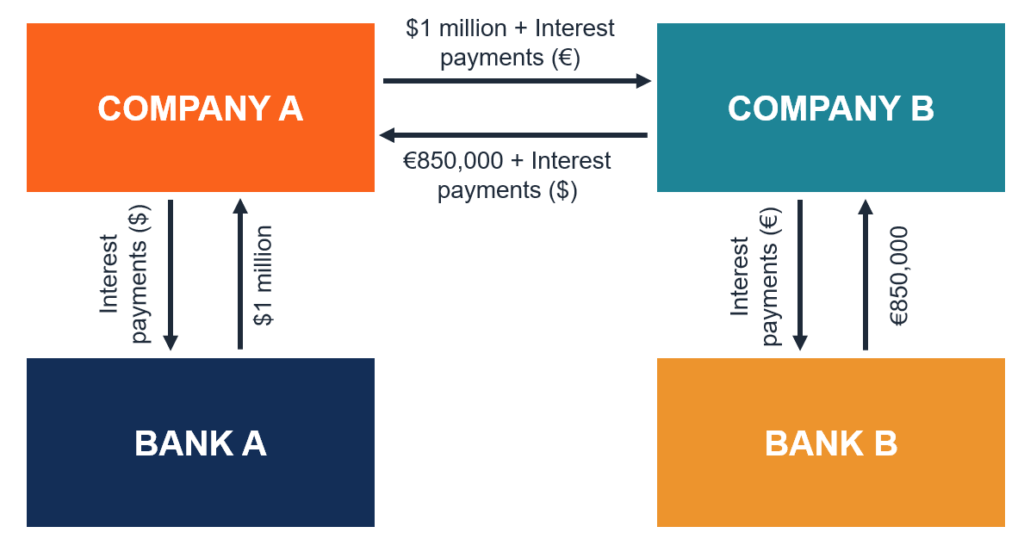

A currency swap is a foreign exchange transaction that involves trading principal and interest in one currency for the same in another currency. It will be a multiple-price-based auction. All brokers listed are trusted have low fees and provide excellent trading education for new traders.

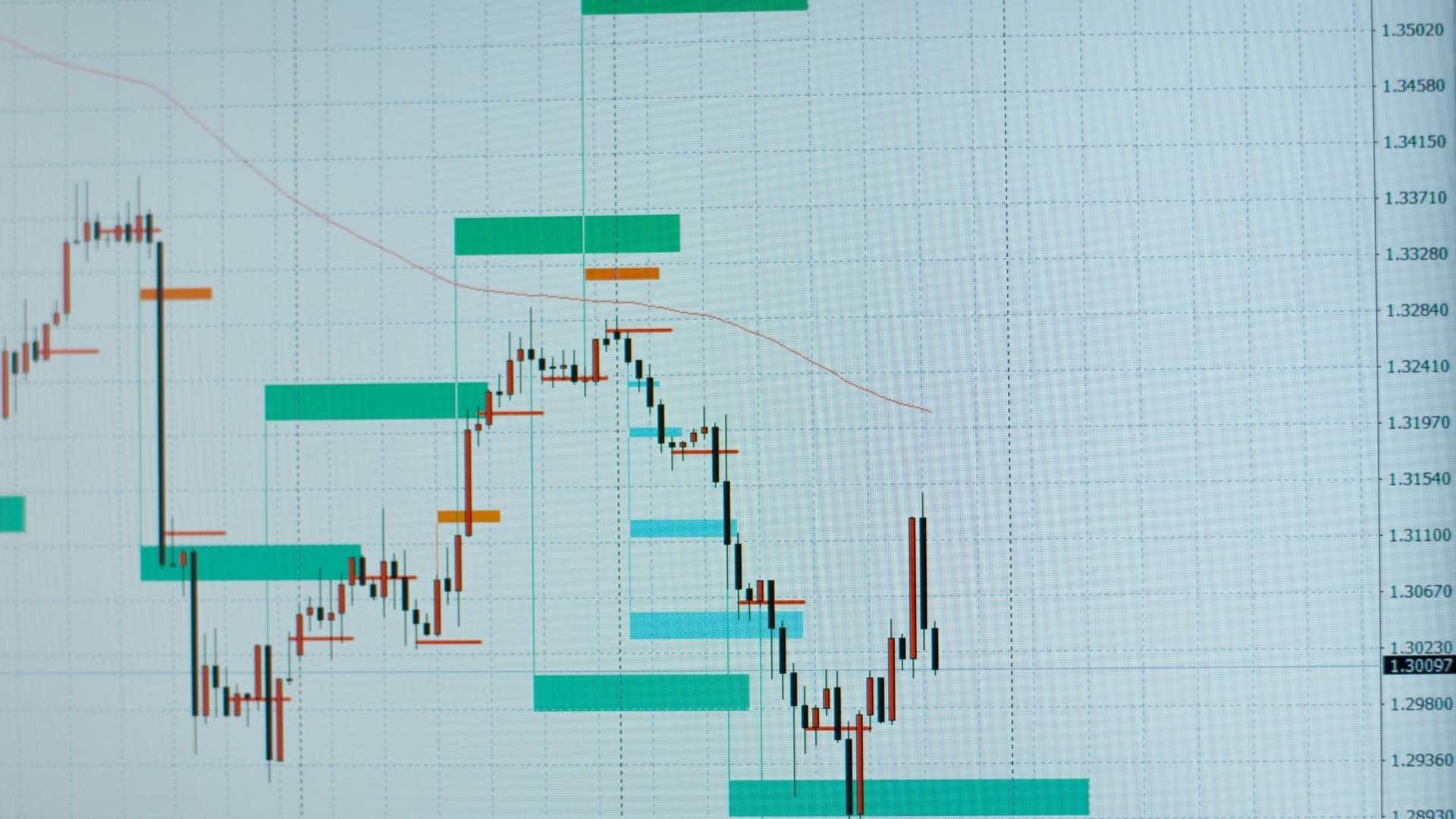

For example EURUSD is a currency pair for trading. It includes all aspects of buying selling and exchanging currencies at current or determined prices. Investors and companies can choose to forgo some return by.

To compile this shortlist of the best brokers in Malaysia we tested 160 Forex brokers catering to Malaysian clients including all brokers regulated by the Securities Commission of Malaysia SCM and the Labuan Financial. Leverage of 1100 means that with 500 in the account the trader has 50000 of credit funds provided by the broker to open trades. It instructs the broker to close the trade at that level.

So 1100 leverage is the best leverage to be used in forex trading. The foreign exchange market Forex FX or currency market is a global decentralized or over-the-counter OTC market for the trading of currenciesThis market determines foreign exchange rates for every currency. Free Low latency collocated VPS.

Platforms Platforms Trade from anywhere on any device at any time. And the lot size can be adjusted in the ratio of at least 200 001 lot for 200 which means an increase in the lot size to 002 you need to have at least 400 and so on but this is recommended but not mandatory in other cases trading with only 1 of your capital then you. Because of the worldwide reach of trade commerce and finance forex markets tend to be the largest and most liquid asset markets in the world.

Raw spreads means really from 00 pips Our diverse and proprietary liquidity mix keeps spreads tight 245. Or Try Free Demo. In terms of trading volume it is by far the largest market in the.

It is agreed that 1100 to 1200 is the best forex leverage ratio. We also publish links for free downloads of trading software. A Stop loss is a preset level where the trader would like the trade closed stopped out if the price moves against them.

A wider set of market participants will have access to the auction. Forex - The foreign exchange also known as FX or forex market is a global marketplace for exchanging national currencies. While currency markets are global so technically never close since at least one of the Sydney Tokyo London and New York forex sessions are operating at any time during the work week brokers.

A Sell means opening a short position with an expectation of falling values. Indias robust forex reserves at 630 billion as on February 11 provide the central bank with the means to undertake the swap.

What Is The Meaning Of Swap In Forex Trading

Do You Pay Swap Fees In Forex Every Time You Hold Overnight Or Do You Pay Only Once And Then You Can Hold On To It Forever Quora

Swap Definition Forexpedia By Babypips Com

What Is Swap In Forex Trading With Examples

What Is Forex Swap Finlogic Net Forex News Swap

Currency Swap Contract Definition How It Works Types

What Is Swap In Forex Trading How Does It Works

Secrets Behind Forex Swap Complete Guide Freeforexcoach Com

Forex Trading Academy Best Educational Provider Axiory Global

The Swap 20 Yearly Gain Forex Strategy Forex Academy

Currency Swap Meaning And Benefits Foreign Exchange Financial Management

What Are Swaps In Forex Forex Academy

What Is The Swap In Forex How Does It Affect Trading

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

/dotdash_final_Currency_Swap_vs_Interest_Rate_Swap_Whats_the_Difference_Jan_2021-01-d0d9bf99a16c467daeab2fd073b67051.jpg)